Blog » Becoming a Coach » Rising Prices, Rising Anxiety: 9 in 10 Millennials feel Anxious over Inflation

Rising Prices, Rising Anxiety: 9 in 10 Millennials feel Anxious over Inflation

The Coach Foundation’s latest survey reveals a startling reality of our times: the escalating impact of inflation on the mental health of millennials. This survey, undertaken with a cohort of 1000 millennials, sought to understand how rising prices are influencing the emotional and financial well-being of this pivotal generation.

Survey Overview

Aimed at gauging the psychological impact of inflation, this survey engaged millennials from varied backgrounds. The participants were asked to reflect on their experiences and concerns in the current economic landscape, marked by increasing inflation rates.

Key Findings

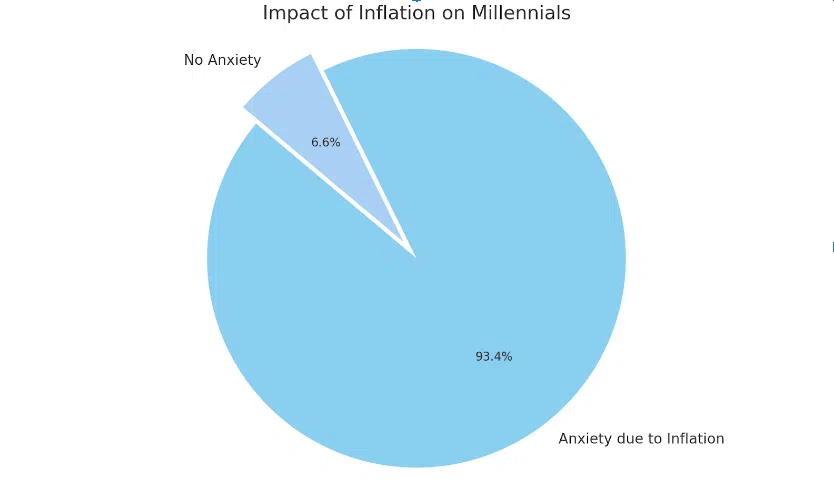

- The survey revealed that a substantial 93.4% of respondents (934 out of 1000) are experiencing anxiety due to inflation. This significant figure highlights the pervasive impact of economic pressures on the millennial generation.

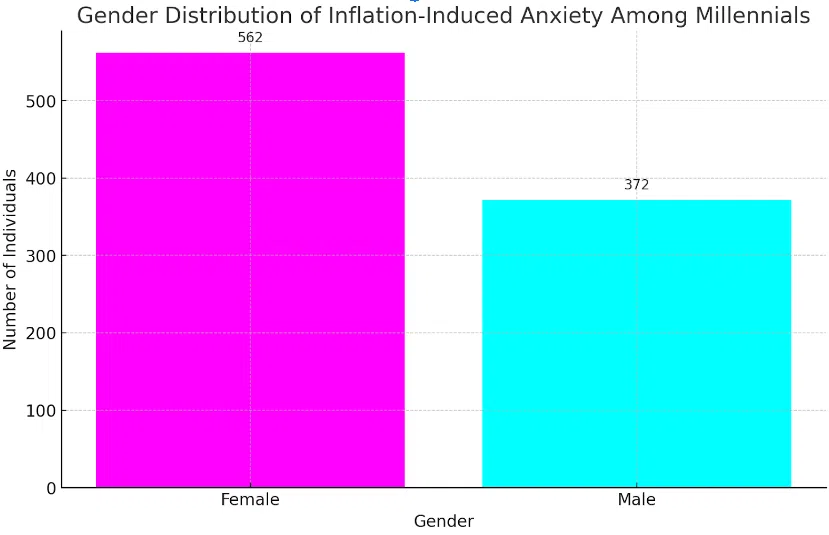

- Among these 934 individuals, 562 are female and 372 are male.

Financial Uncertainty Leaves Millennials Battling the Blues

Inflation has profoundly impacted millennials’ approach to financial planning and stability. With prices soaring, many are finding it increasingly challenging to maintain a standard of living, save for the future, or invest in personal growth.

Out of 1000 millennials surveyed, a remarkable 93.4%, which translates to 934 individuals, reported feeling anxious about the rising costs and their financial future. This figure is more than just a statistic; it’s a stark representation of a generation grappling with economic uncertainty.

This segment, in a lighter shade of blue and slightly exploded for emphasis, represents the 934 millennials (93.4%) who reported experiencing anxiety due to inflation. This large portion of the chart visually underscores the significant impact of inflation on the mental health and financial well-being of this generation. So 9 in 10 millennials feel overwhelmed by the current economy.

Among the 934 millennials, 562 are female and 372 are male. This distribution indicates that while both genders are significantly affected, a higher proportion of females are reporting anxiety due to inflation. This disparity could be indicative of broader socio-economic dynamics, including wage gaps and industry-specific challenges.

The current economic landscape, marked by soaring prices, has made it increasingly challenging for many to maintain their standard of living. The survey data indicate that a significant number of millennials are struggling to balance day-to-day expenses with long-term financial goals, such as saving for retirement or investing in personal growth opportunities.

The psychological impact of this financial strain is another critical aspect highlighted by the survey. For many millennials, the constant pressure to navigate through financial uncertainty is leading to heightened levels of stress and anxiety. This is not just about the numbers in their bank accounts; it’s about the sense of security and the ability to plan for the future, both of which are fundamental to personal well-being.

Conclusion

The Coach Foundation’s survey brings to light a critical but often overlooked aspect of our economy: the psychological toll of inflation, particularly on millennials.

The findings call for a more holistic approach to economic policy-making, one that considers the mental well-being of people alongside financial stability.

Methodology

The survey methodology was comprehensive, incorporating both qualitative and quantitative research techniques. A randomized selection process ensured a representative sample of the millennial population, encompassing various socioeconomic statuses.

The survey’s structure was designed to elicit detailed responses on the personal impact of inflation, providing a well-rounded understanding of the issue.

ABOUT SAI BLACKBYRN

I’m Sai Blackbyrn, better known as “The Coach’s Mentor.” I help Coaches like you establish their business online. My system is simple: close more clients at higher fees. You can take advantage of technology, and use it as a catalyst to grow your coaching business in a matter of weeks; not months, not years. It’s easier than you think.

AS SEEN ON

0 Comment